when is tax season 2022 south africa

Taxpayers who submit their annual returns via eFiling have until the 24th of October 2022 to submit their returns. With the 20212022 SARS tax eFiling season now open and well underway this blog aims at.

Corporate Tax In South Africa A Guide For Expats Expatica

SARS definitely improving their service they have realised there is a mad rush once the tax season starts so they have started early with their notifications.

. Published by TGS South Africa at July 27 2022. In general only if you received income that is taxable do you need to submit a tax return to the South African Revenue Services SARS. 18 of taxable income.

Individuals and special trusts Taxable Income R Rate of Tax R. Friday July 1 2022. Tax Season 2022 Now Open.

Value-Added Tax VAT electronic submissions and payments CIT Provisional payments. Beware This Years Deadlines are Shorter. What are the tax return rates for the 2022 tax year.

Notice in terms of section 25 of the Tax Administration Act 2011 read with section 66 of the Income Tax Act 1962 for submission of income tax returns for the 2022 tax year. A SARS Media Release 2021 list is available. R38 916 26 of taxable income above R216 200.

For normal taxpayers this is when your employment income during the 2022 tax year exceeded R87 300 if you are under the age of 65. The 2022 tax season opened on the 1st of July 2022. 1 day agoWith tax season open many taxpayers in South Africa will be receiving their auto-assessments from SARS.

Tax season is the period in which taxpayers must complete and submit their tax returns to SARS. The dates for submission of returns are specified in the notice. Tax rate year of assessment ending 28 February 2022 45.

3 June 2022. July 28 2022 Thursday. R70 532 31 of taxable income above R337 800.

This webinar comes at an opportune time ahead of the 2022 tax filing season which opens on 1 July 2022. R216 201 R337 800. R337 801 R467 500.

18 of taxable income. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. When does SARS Tax season 2022 Start in South Africa.

When does the 2022 tax filing season start in South Africa. Posted 10 June 2022 The 2022 filing season opens on 1 July. Tax rates from 1 March 2022 to 28 February 2023.

Taxable income R Rates of tax R 1 216 200. On this day contributions to a retirement annuity and tax-free savings account are collated so that we can report to the South African Revenue Service SARS for the tax year 1 March 2021 to 28 February 2022. The South African Revenue Services Sars confirmed that the filing date will be 1 July 2022 to 24 October 2022 and registered provisional Individual taxpayers who file via the E.

Is Your Trust Registered and Ready for Income Tax. Interest from a South African source earned by any natural person under 65 years of age up to R23 800 2022. Jul 01 2021.

R34 500 per annum is exempt from taxation. Value-Added Tax VAT manual submissions and payments. Tax season 2022 is almost here.

Here are the tax rates based on income earned during the 2021 tax year. South Africa Residents Income Tax Tables in 2022. Tax Season 2022 SARS have recently announced some changes.

Thats just around the corner. Rate of tax R R1 R216 200. South African expatriates should not only understand the newly implemented 20212022 tax laws which aim at taxing their foreign employment income but should also act if they want to avoid its dire consequences.

While a few things have changed with. During the session we will be addressing the most frequently asked questions from South African Residents Working Abroad relating to Section 10ioii income tax returns with a recap of the latest developments and set requirements that must be met. The filing season which opens during the first week of July includes all categories of individual taxpayers provisional and non-provisional as well as trusts.

216 201 337 800. It is important to be aware that the season is shorter than prior years. With the filing season getting underway today the South African Revenue Service SARS has made significant changes to the 2022 tax filing season.

If you are older than 65 it is when your employment income exceeded R135 150. R23 800 per annum and persons 65 and older up to R34 500 2022. The Tax tables below include the tax rates thresholds and allowances included in the South Africa Tax Calculator 2022.

Year ending 28 February 2022. The tax season 2022 for individuals is upon us. SARS tax year 2022 starts 1 July 2022 are you ready.

The introduction of auto-assessments among other. 1 July 2022. We are here to help you get ready by making sure you know the relevant deadlines and closing dates.

South Africa Blue Sky Publications Pty Ltd TA TheSouthAfrican Number. With Offices Situated In Johannesburg Cape Town And Durban We At Tgs South Africa Focus Our Expertise On Owner. July 29 2022 Friday.

Tax rates are the values that are payable to SARS by law. The South African Revenue Service begins tax season for individuals on the 1 July each year with tax season usually closing in November each year. South Africa Site secured by Comodo Security.

29 June 2022 The South African Revenue Service SARS has made significant changes to the 2022 Tax Filing Season. Dividends received by individuals from South African companies are generally exempt from income tax but dividends tax at a rate of 20 is withheld by the entities paying the dividends to. Taxpayers may also submit.

According to PWC. 38 916 26 of taxable income above 216 200. This year over 3 million individual non-provisional taxpayers have been auto-assessed by SARS and will not have to file a tax return if they are satisfied with the outcome.

SAnewsgovza Tshwane With the filing season getting underway today the South African Revenue Service SARS has made significant changes to the 2022 tax filing season. Stay on top of your. July 25 2022 Monday.

Tax On Investments What You Need To Know Taxtim Sa

Pin By Digimarkinfo Img Vid On Taxcode In 2022 Income Tax Return Tax Return Income Tax

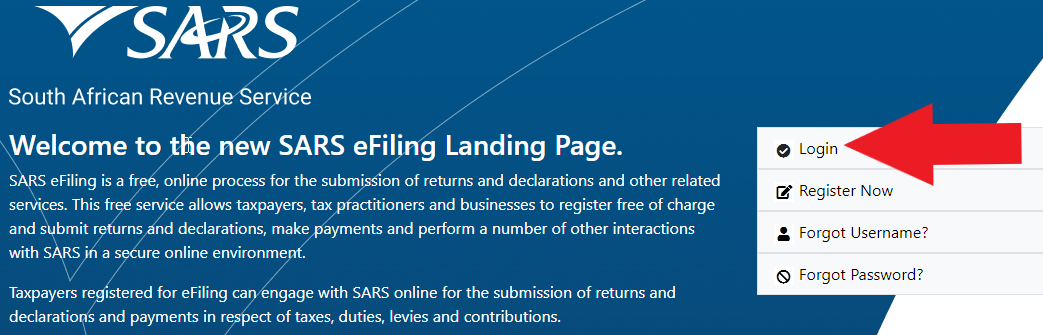

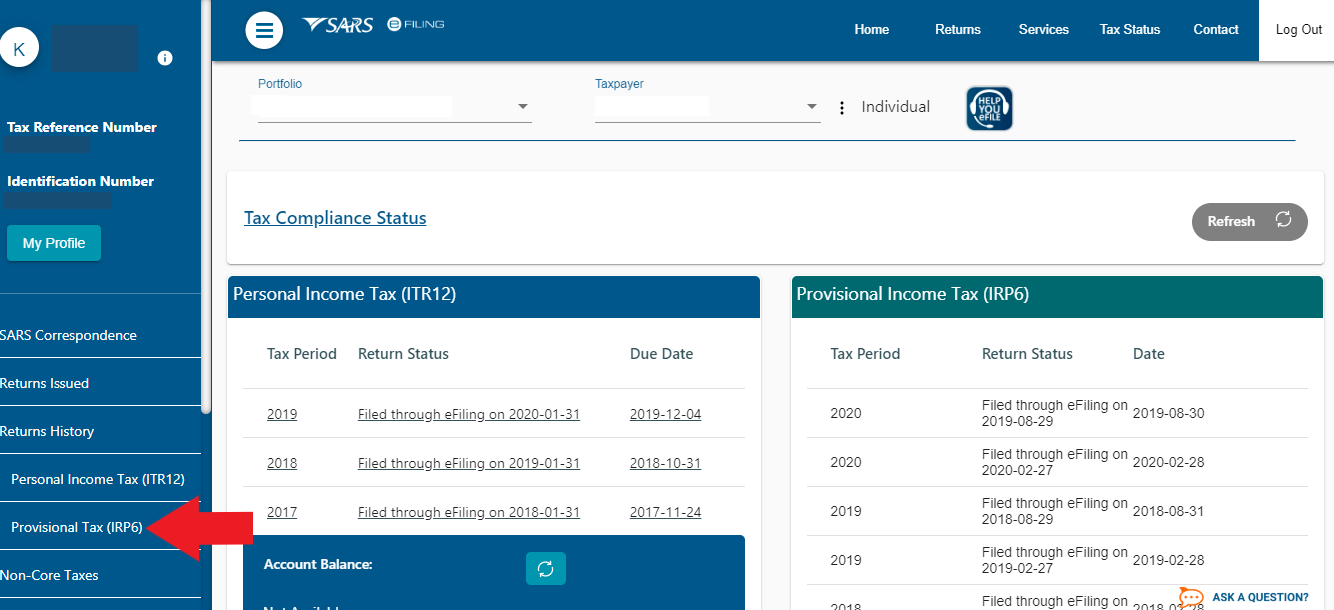

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Sars Efiling How To Submit Your Itr12 Youtube

Sars Efiling Registration 2022 2023 Application Portal Www Sars Gov Za In 2022 Personal Finance Finance Application

How To File Your Income Taxes In South Africa Expatica

Corporate Tax In South Africa A Guide For Expats Expatica

How To File Your Income Taxes In South Africa Expatica

Average Income Tax Rates Comparisons South African Revenue Service

South African Revenue Service Sars

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Effectiveness And Cost Effectiveness Of Reactive Targeted Indoor Residual Spraying For Malaria Control In Low Transmission Settings A Cluster Randomised Non Inferiority Trial In South Africa The Lancet

Average Income Tax Rates Comparisons South African Revenue Service

Sars Mobiapp How To Submit Your Income Tax Return Itr12 Youtube

![]()

Climate Governance In South Africa Climate Action Tracker

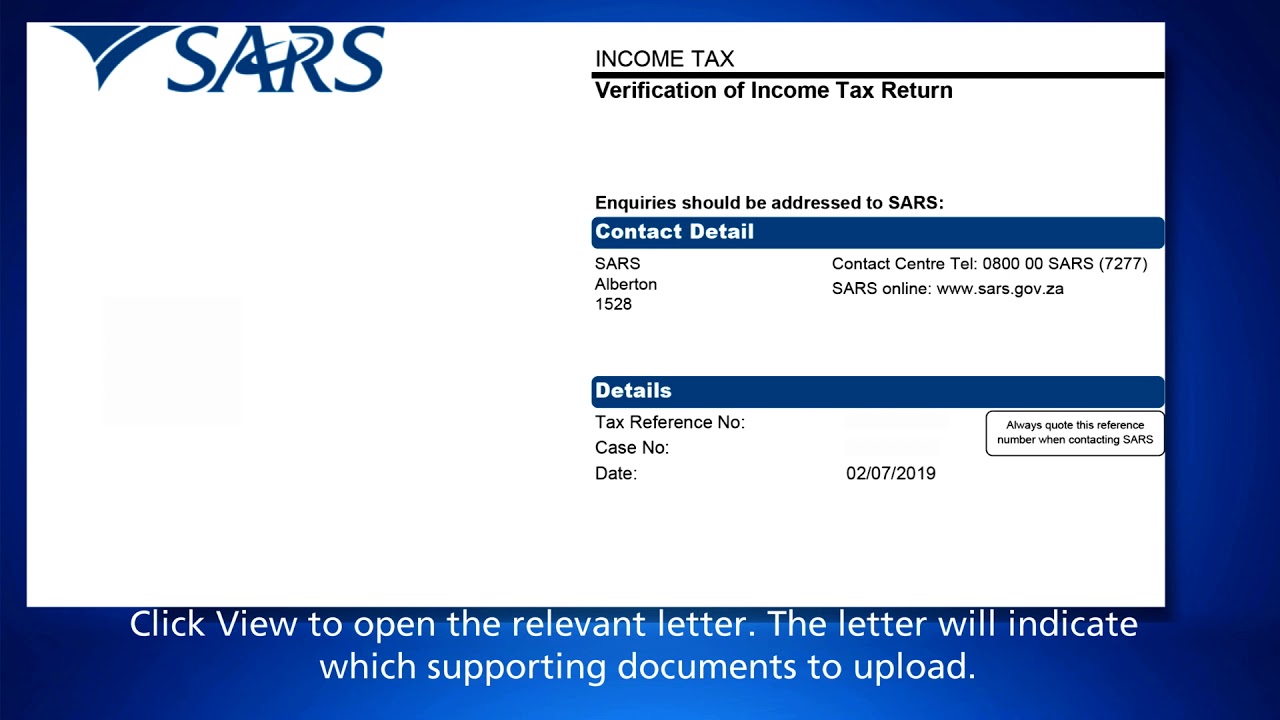

Sars Efiling How To Submit Documents Youtube